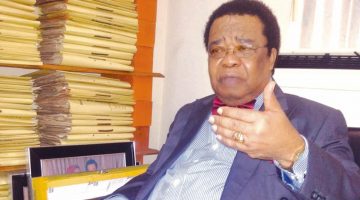

Kyari Abba Bukar is the Managing Director and Chief Executive Officer of the Central Securities Clearing System (CSCS) Plc as well as the Chairman of the Nigerian Economic Summit Group (NESG). Prior to joining CSCS in September 2011,Kyari was the MD/CEO of ValuCard Nigeria Plc (now Unified Payments Plc) where he achieved phenomenal successes by transforming the business from a loss making, low morale and close looped local e-payment player into a highly profitable, world-class, global payment processor in partnership with Visa International Company. Kyari worked for FSB International Bank (now Fidelity Bank) where he rose to the position of Executive Director, E-Banking and Information Technology and Operations. Prior to that, he worked at Hewlett – Packard USA in Silicon Valley, California. He held several positions amongst which are Process and R&D Engineer, Performance Programme and Benchmarking Manager, Marketing Programme Manager and Senior IT Consultant, World Wide Technical Marketing Manager until his return to Nigeria in 2002. He sits on the Board of Credit Registry Services Plc and Member of the Board of Trustees of the Investor Protection Fund of the NSE. He was one of the members of the Nigerian National Conference representing the organized Private Sector Group (NESG). He holds a B.Sc. degree in Physics from Ahmadu Bello University, Zaria, M.Sc. in Nuclear Engineering from Oregon State University, USA. He is also an alumnus of Lagos Business School (LBS), Wharthon Business School and Harvard Business School. In this interview with BUKKY OLAJIDE, Bukar talks about how CSCS achieved full dematerialisation and how the unclaimed dividend saga could be resolved. Excerpts.

How would you describe the operational profile of CSCS ?

The CSCS is the Central Security Depository for the Nigerian Capital markets. We do the clearing and settlements of all transactions in the Nigerian capital markets. And then the settlements is where the obligations are now credited or debited on a basis to the account of the participants and by extensions to the accounts of the individual investors.

CSCS has been in that business for quite a while and we believe that we as an entity of what I call a trusted party in the middle in terms of the transactions that take place on the floor of the Nigerian Stock Exchange or even Over-The-Counter or National Association of Securities Dealers [NASD] in the corporate element of Financial Market Dealers Quotation [FMDQ] and we are soon going to look at ourselves playing that role that I believe in the various commodities exchanges that are going to berth in Nigeria.

Essentially, as a trusted party, you have to ensure that you give that trusted confidence to the investors and of course to the participants and by extension to the investors.

In our own case, it is our core value that is basically the bedrock of how we conduct ourselves. Everybody actually jumps at technology and all of that. Yes, technology is key. Of course, just like any kind of vehicle that you use comes with the responsibility of how to drive it and what processes you need to ensure that are in place.

So, we use technology to effectively and efficaciously do what we do, that is, basically, the clearing and settlement of transactions in the market.

Now, obviously, you’ve heard about ISO certification. This is a process that rests on our S.E.C.U.R.E. core values, security elements, when it comes to security, then, the IT security are the overall company-wide security of information that pass through us or entrusted to us.

The ISO certification is basically the icing on the cake as far as we are concerned when it comes to ensuring that the assets or the information that are entrusted to us are safeguarded fairly well. So, we are very proud of this achievement and it is worth celebrating because it is a rare opportunity for us to tell all our stakeholders, our investors, our participants as well as our regulators that we have achieved a major significant milestone.

What will be the macroeconomic impact of Basel 111 on the Nigerian economy?

Basel III is an international standard that I believe must be in reference to banks. It is a standard that banks adhere to.It is basically the ratios that demand the banks must keep in terms of capital adequacy. Essentially, it is one of the major risk management tools or processes that the banks require to ensure that they are adequately capitalised and they do not go into extremely risky ventures, and if they must, they have to raise capital to ensure that they are within those Basel III requirements.

And if you have sound banks and sound banking system, then you have a fundamental building block of your economy for the economic development of a nation on a very strong foundation and then the rest would be government policies that will drive the economy of the country.

Unclaimed dividend saga has continued to assail the investing public? Is there any new action being taken to address this issue?

The major role we play is that of being a major stakeholder in the capital market when it comes to dividend payout and so on. I believe that the registrars have the primary responsibility when it comes to dividend payment. And obviously the Securities and Exchange Commission (SEC) is the main driver of making pronouncements that will ensure that we see a reduction in unclaimed dividends and I think a lot is going on about this.

One is the fact that we have been a part of major stakeholders’ team or task force that are together with the registrars and the SEC. We are pushing for full dematerialisation in the market.

Once you achieve full dematerialisation, we will now have the information of each and every investor and assuming with the BVN and KYC requirements which the stockbrokers and the registrars to a lesser extent have major responsibility to.

If we can now achieve full compliments of our data base with customers’ KYC requirements plus their bank accounts and also we have achieved full dematerialisation, then going forward, payment of dividend will become automatic and will be full and complete.

Even if we achieve 95 per cent payment of dividends going out by virtue of the usage of e-dividend, then the remaining thing we will need to pay attention to will be the legacy which is the large sum you are talking about. And that means, with time, we are going to deplete it. And of course, SEC has issued a circular to the registrars to remit all old dividends back to the issuers, back to the companies that issued the dividends.

Essentially, that means that it’s still a liability and that if the shareholders show up, the company will still end up paying them through the registrars of course. That is what the industry is doing towards addressing unclaimed dividend but I believe very strongly in fixing the legacy issues so that going forward, we do not have accumulation of unclaimed dividends and that is one, to do the full dematerialization. Two, to populate and ensure that the data of every investor is fully populated including their BVN and bank account details. And with that, we will be able to achieve full dividend payout overtime.

Again, what have you done so far in your efforts to achieve full dematerialization in the stock market?

What we have done is that along with the registrars, we have been able to secure our full database, which have now made us to achieve a 100 per cent in that regard.

But I’ve been very careful not to say dematerialisation because what we have done is that the data that the registrars have given us, that is, the ones that are certificated, we have now translated into electronic format. It’s still in what is called ‘immobilised’ state which means that a person who wants to move his or her certificate which has now been immobilised in the data base of CSCS, if you want to dematerialise it, all you need to do is go to your registrar, do the validation there and then the registrar now sends us the information, then we now move it to our data base.

So, that is still not quite 100 per cent, the full dematerialization but the immobilized data in the dematerialized data will now have complete visibility to the entire data base of the investors.

Dubai’s stock market was rated the world’s best performing. How can the Nigerian bourse improve on its current rating?

Markets go up; markets go down because there was a time when Nigerian Stock market did like 36 per cent. It was among the top three in the world but lately, because of the economic headwinds that we face as a country, including the monetary stance of the CBN, we have seen some challenges in the market.

That has done two things for us. One, is that the market has been down so far. Two, for somebody who is a market watcher, you will notice that the volume of transactions have gone down significantly compared to last year or two years ago. We used to do somewhere in the order of N4 billion in terms of value of transactions per day, now we are doing at best on an average of N1.6 billion, so there has been a significant downturn in terms of the value of transactions on a daily basis.Immensely, these are reflections of how the economy is. The challenges we face in the economy is being reflected in the market performance.

About 70 per cent of Nigerians live under poverty line. What do you think is the way out?

There is a phrase that I like using, that I shared at a session that we had a few weeks ago which is wealth to well-being. Wealth is basically what you have, but then, people say we are rich country and now begin to list all the things that they think make us rich. You know, we have huge arable land and everything that people share are what you might call potentials and that certainly is wealth if you can exploit them smartly. Now, to translate that to wellbeing of every citizen is the big challenge and we can do that in a very smart and intelligent manner. If you want to reduce the level of poverty in an economy, you create jobs. And government do not create jobs, but enabling environment, so that entrepreneurs and private people and companies can create jobs.

So, whether it is agriculture, it’s not just the farmer size of the agriculture, it is the entire value chain. We can have processing, we can build warehouse, we can have warehouse managers, we can have people that do the housing and quality standards and so on.

Basically, the entire agriculture value chain have huge potentials of creating millions of jobs. The same thing is solid minerals. Solid mineral is an area that if it is properly regulated and managed, we can see ourselves creating jobs and at the same time getting the mining resources then have the value chain so that we don’t export crude.

If we decide to just mine and sell the crude, it is not different from oil. We need to get ourselves out of that quagmire of exporting crude of anything, even if oil. We should have enough refineries to process all of them. That way, we will be creating value and value-added products.So, those are some of my recommendations for alleviating the huge or high level of poverty in the country.

There is ‘Project Meridian’ signage in the building. Can you please explain what it is all about?

Project Meridian is a project that we have in place. We are in the process of migrating our core CSD application. The current system that we have is a system that we’ve heard for over 10 years, so we are in the process of replacing it.

So, our board has approved and we’ve already signed and approved the TATA Consulting Company that we are using. We are going to use TCS-BaNCS. So, we are in the midst of implementation of that project and we expect to go live sometime next year with a brand new system that is world class and more modern and that will make things more efficient.

By: Bukky Olajide